An old chestnut of VC advice suggests the best investment opportunities are found in traditional startup ecosystems, primarily in Silicon Valley. At Endeavor, we’ve always believed the opposite: that nurturing entrepreneurial talent in underserved markets can have a massive impact and generate meaningful returns. Now, the respected Kauffman Fellowship has set out to settle the debate once and for all by measuring individual attribution to funds.

Amongst a seasoned and successful peer group, Allen Taylor, the Managing Partner of Endeavor Catalyst, our rules-based co-investment fund, is ranked number one amongst Kauffman VC colleagues in his ability to secure high returns on investments, according to the Kauffman Fund Returners Index.

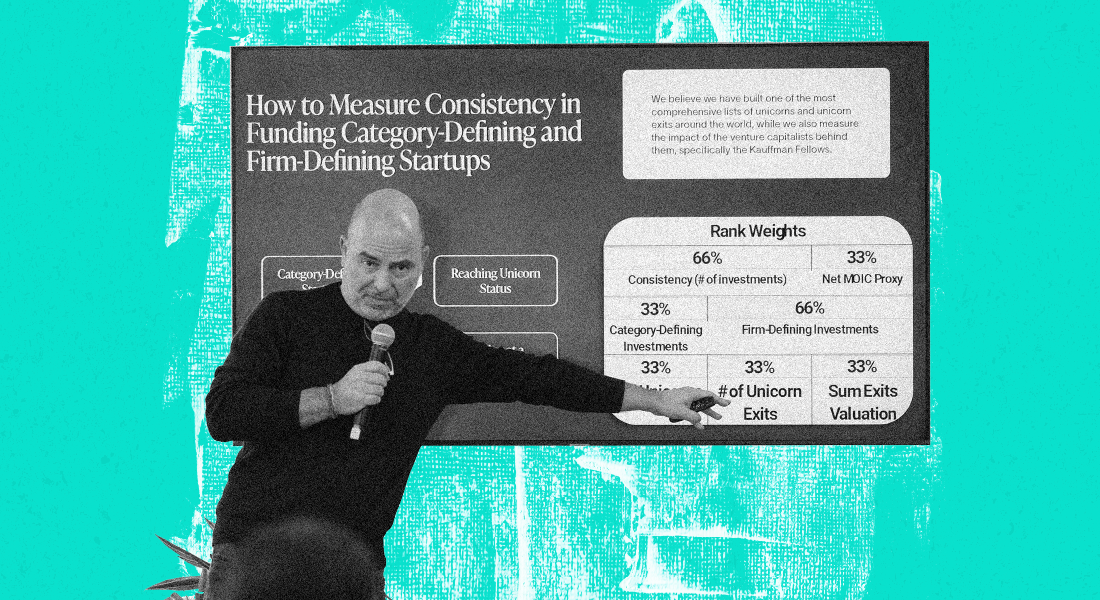

At the Endeavor Catalyst Gathering in New York, Kauffman Fellows CEO Fernando Fabre discussed defining and measuring success in venture capital, including insights on the Kauffman Fund Returners Index, captured in the video below.

It’s a triumphant verdict for the power of investing in elsewhere markets. At Endeavor Catalyst, we’ve supported 63 unicorns and seen 30 successful exits. Over the past 12 years, we’ve made 360+ investments in 35+ countries and seen 10 IPOs.

Allen’s success, and Endeavor Catalyst’s success at large, is marked by consistency in finding, investing, supporting and exiting category and firm-defining startups. Category-defining startups reinvent an entire industry or region (think Airbnb for hotels or Uber for transportation). While firm-defining startups have such a massive exit that they transform a venture capital firm’s reputation, like Zoom for Emergence or Coinbase for Union Square Ventures.

The Kauffman Fund Returners Index (KFRI) offers crucial insight into VC success and makes it possible to rank investors based on their ability to secure high returns on their investments. It comes from the Kauffman Fellows, which is a lifelong learning community for people representing the future of the venture capital industry. There are a thousand Fellows across the world; one in five minted unicorns globally over the past 10 years has a Kauffman Fellow on the cap table. The majority of fellows are senior-level and their investments have generated $300B in liquidity over the last decade.

Unlike the Midas List, the KFRI operates over a period of 10 years for a clear reflection of the venture capital cycle. It shows no precedence for timing or deal terms, because Kauffman Fellows believes that all venture capital models are industry-additive.

The data from the KFRI belies the traditional belief that most entrepreneurial magic happens in Silicon Valley.

About 250,000 startups received venture capital in the last decade; roughly 1,800 became unicorns, and 1,400 still exist today as unicorns. Three hundred have exited, 79 are no longer unicorns, 27 went out of business. The US minted 50% of all unicorns (25% in California alone!), China minted 25% and the rest of the world created another 25% — meaning that 75% of minted unicorns from the last decade were not minted in Silicon Valley. This is a huge reversal to accepted VC status quo, proving that elsewhere markets offer one of the greatest opportunities for growth, returns and overall success.

Behind the data proving the veracity of investing globally lie the stories and people that make up the heart of Endeavor.

Sergio Fogel graduated high school without ever touching a computer; an unlikely origin story for the tech entrepreneur who would co-found dLocal, Uruguay’s first unicorn.

Hande Cilingir grew up in Turkey believing her path would be in corporate life, until she and five friends built Insider, a marketing technology platform that today competes with giants on a global stage, becoming one of Turkey’s first unicorns.

Antonis Malaxianakis went from CEO of his family’s outdoor furniture business to an internship to creating Harbor Lab, a €75 million Greek company disrupting the shipping industry.

We could – and do – tell so many more stories if we look beyond Silicon Valley.

Featured Stories

Rafal Modrzewski (ICEYE) and Renato Panesi (D-Orbit) on space: The new wild west

Matt Harris explains why destiny is bullshit and the future is chaos (and that’s a good thing)

Four VCs on why illiquidity is a feature, not a bug… and more

2024 Endeavor Catalyst Annual Report: A Look into Global Venture Capital

The future of fintech — and why money without context doesn’t work

Related Articles

Rafal Modrzewski (ICEYE) and Renato Panesi (D-Orbit) on space: The new wild west

Matt Harris explains why destiny is bullshit and the future is chaos (and that’s a good thing)

Four VCs on why illiquidity is a feature, not a bug… and more